Table of Contents

Introduction: The Growing Threat of RFID Scanner Fraud

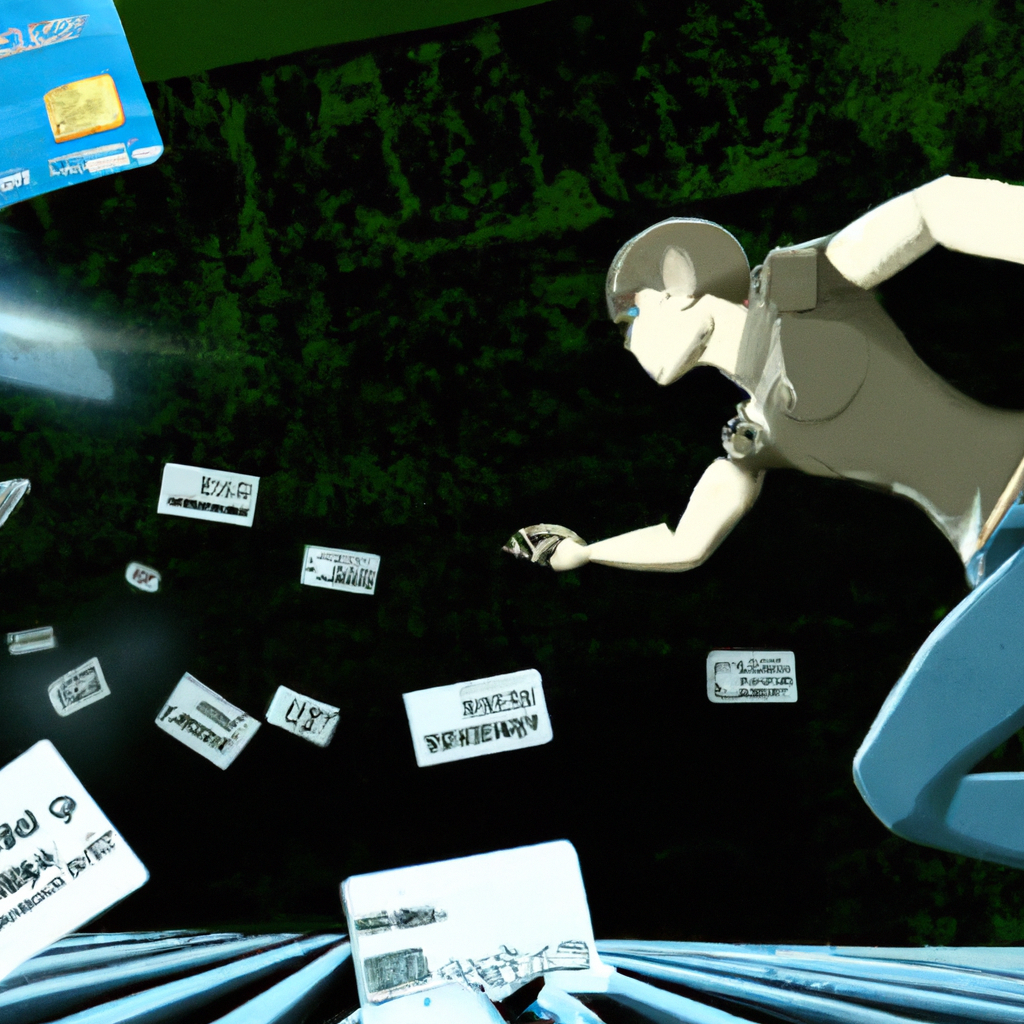

In today's digital age, credit card fraud has become a common occurrence. With the rise of contactless payment methods, such as RFID (Radio Frequency Identification) technology, the threat of credit card fraud has increased significantly. RFID scanner fraud is a silent thief that can steal your credit card data without you even realizing it. This type of fraud is becoming more prevalent, and it is essential to understand how it works and how to protect yourself from it. According to a report by the Nilson Report, global card fraud losses reached $27.85 billion in 2018, and it is expected to increase to $35.67 billion by 2023. RFID scanner fraud is a significant contributor to this growing problem. Criminals can use RFID scanners to steal credit card data from unsuspecting victims, and they can use this information to make unauthorized purchases or even steal the victim's identity.

How RFID Scanner Fraud Works: Understanding the Silent Thief of Your Credit Card Data

RFID technology is used in many contactless payment methods, such as credit cards, debit cards, and mobile payment systems. This technology allows the user to make a payment by simply tapping their card or device on a reader. However, this convenience comes with a significant risk. Criminals can use RFID scanners to intercept the radio waves emitted by the card or device and steal the credit card data. RFID scanners are readily available online and can be purchased for as little as $50. Criminals can use these scanners to steal credit card data from a distance of up to 10 feet. They can do this by simply walking past their victim with an RFID scanner in their pocket or bag. The scanner will pick up the radio waves emitted by the victim's credit card and steal the data. Once the criminal has the credit card data, they can use it to make unauthorized purchases or even steal the victim's identity. They can use the stolen data to create a fake credit card or use the information to make online purchases. The victim may not even realize that their credit card data has been stolen until they receive their next statement.

Protecting Yourself from RFID Scanner Fraud: Tips and Strategies for Keeping Your Information Safe

Fortunately, there are several ways to protect yourself from RFID scanner fraud. One of the most effective ways is to use an RFID-blocking wallet or sleeve. These products are designed to block the radio waves emitted by your credit card, preventing criminals from stealing your data. RFID-blocking wallets and sleeves are readily available online and in stores and are an affordable way to protect yourself from this type of fraud. Another way to protect yourself is to be vigilant when using your credit card. Be aware of your surroundings and keep an eye out for anyone who may be trying to steal your data. If you notice someone acting suspiciously, report it to the authorities immediately. It is also essential to monitor your credit card statements regularly. Check for any unauthorized purchases or charges and report them to your credit card company immediately. The sooner you report any fraudulent activity, the better chance you have of recovering your money and preventing further damage.

Conclusion: Staying Vigilant Against RFID Scanner Fraud in an Increasingly Digital World

RFID scanner fraud is a growing problem in today's digital age. Criminals can use this technology to steal credit card data from unsuspecting victims, and it is essential to understand how it works and how to protect yourself from it. By using an RFID-blocking wallet or sleeve, being vigilant when using your credit card, and monitoring your statements regularly, you can reduce the risk of becoming a victim of this type of fraud. As technology continues to advance, the threat of RFID scanner fraud will only increase. It is essential to stay informed and take the necessary precautions to protect yourself from this silent thief. By staying vigilant and taking proactive steps to protect your information, you can reduce the risk of becoming a victim of RFID scanner fraud and keep your credit card data safe.